Author: brennerhill

Home Buying Etiquette: 8 Things to Keep in Mind

House hunting can be an exhilarating adventure, filled with emotions, excitement, and the occasional burst of candid remarks. While it’s important to be honest with your real estate agent there are some things you should avoid saying when interacting with sellers or their agents. As the saying goes, “What you say can—and will—be used against … Continued

Buying a Home: I Have an Accepted Contract, Now What?

Congratulations! You’ve successfully navigated the competitive real estate market and secured an accepted contract on your new home. It’s an exhilarating milestone in your home-buying journey, but it’s also the beginning of a series of important steps that will lead you to closing day. So, what comes next? In this blog post, we’ll guide you … Continued

Buying a Home: 10 Important Questions to Ask a Real Estate Agent Before Hiring

Are you in the market to buy a new home or property? Congratulations on this exciting journey! However, navigating the real estate market can be a complex and overwhelming experience, especially if you’re doing it for the first time. That’s where a qualified buyer’s real estate agent can make all the difference. But how do … Continued

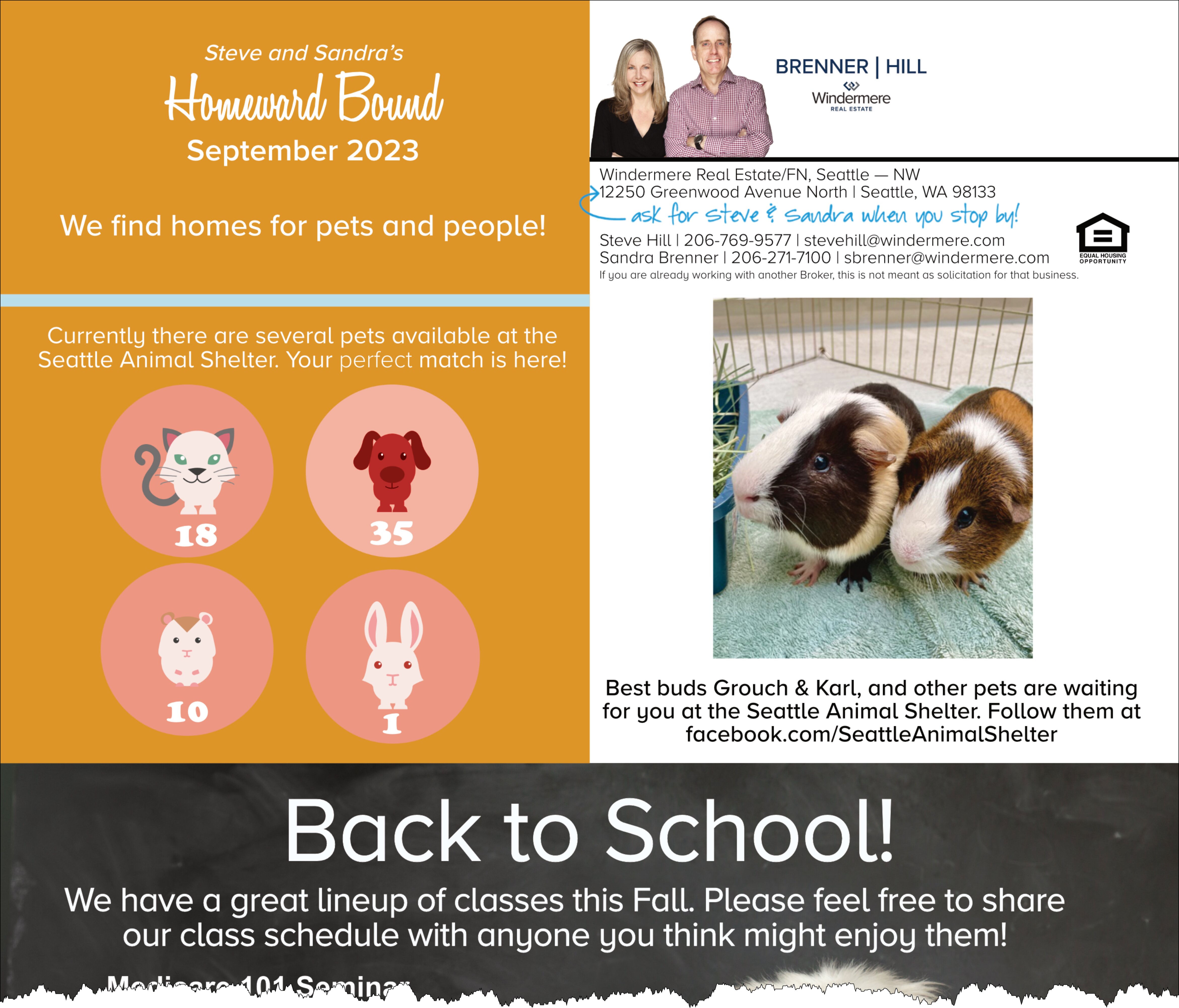

Free Medicare 101 Workshop | September 27, 2023

Cornerstone Insurance Group is an independent insurance agency that is not connected with or endorsed by the United States government or the federal Medicare program. RSVP is not required to attend these seminars.

NW Seattle & SW Snohomish Real Estate Market Update | September 11, 2023

For the past two weeks Sellers in SW Snohomish have had a more robust market than Sellers in NW Seattle. It looks like Buyers did not get the memo that they were supposed to start Buying after the holiday weekend! Contracts were down 31% in NW Seattle and down 32% in SW Snohomish. One of … Continued

The 3 Rules of Home Affordability

Mortgage lenders use qualification ratios to determine the amount they will lend to borrowers. While ratios may vary slightly among lenders, they generally fall within the same range. To help determine an individual’s qualifications, mortgage lenders typically use the following three ratios. Rule of 28: Your maximum mortgage payment should not exceed 28% of your … Continued

How Do I Know if I’ve Hired the Wrong Real Estate Agent?

If you’re embarking on the journey of buying or selling a house for the first time, chances are you haven’t had much experience working with a real estate agent. The excitement of the process might have overshadowed the importance of thoroughly researching and interviewing prospective agents to find the right fit. However, overlooking this crucial … Continued

Buying a Home: 10 Things NOT To Do Before Buying a Home

If you’ve been pre-approved for a mortgage, you’re probably assuming you can breathe easy and focus on finding the home of your dreams without needing to worry about the loan any further. Unfortunately, that’s not the way it works. There is a huge difference between being pre-approved for a mortgage and being approved … Continued

Buying a Home: Demystifying Mortgage Pre-Approval vs. Pre-Qualification — What’s the Difference?

The journey to homeownership often begins with exploring your mortgage options, and two terms you’ll frequently encounter are “pre-approval” and “pre-qualification.” While these sound similar, they serve distinct purposes in the homebuying process. And one is more valuable to you when presenting an offer to buy your home. In this blog post, we’ll unravel the … Continued